Best Chatbots for Finance & Banking: AI in the Financial Industry

AI chatbots are transforming banking by automating tasks like balance checks, fraud detection, and customer support. They offer 24/7 service, reduce wait times, and improve security. Popular examples include Erica (Bank of America), Eno (Capital One), and COIN (JPMorgan Chase). These tools save costs, enhance efficiency, and provide personalized financial advice.

Key Features of Banking Chatbots:

- Account Monitoring: Track balances and spending.

- Transaction Support: Payments and transfers.

- Fraud Alerts: Detect unusual activity.

- Customer Assistance: Solve common issues.

Quick Comparison:

| Chatbot | Key Features | Unique Strengths |

|---|---|---|

| Erica (Bank of America) | Alerts, spending insights, credit tracking | Over 1 billion interactions handled |

| Eno (Capital One) | Real-time fraud alerts, virtual cards | Secure online shopping |

| Amy (HSBC) | Multilingual support, branch locator | Language versatility |

| COIN (JPMorgan Chase) | Contract analysis, risk assessment | Internal process focus |

AI chatbots are reshaping banking by improving security, simplifying tasks, and offering tailored advice. By 2027, 25% of organizations are expected to rely on chatbots for customer service.

AI in banking: TOP use cases and examples

Popular Banking AI Chatbots Today

Banks worldwide are now using AI chatbots to handle everything from basic transactions to more complex financial tasks. Here are some examples that highlight their growing range of features.

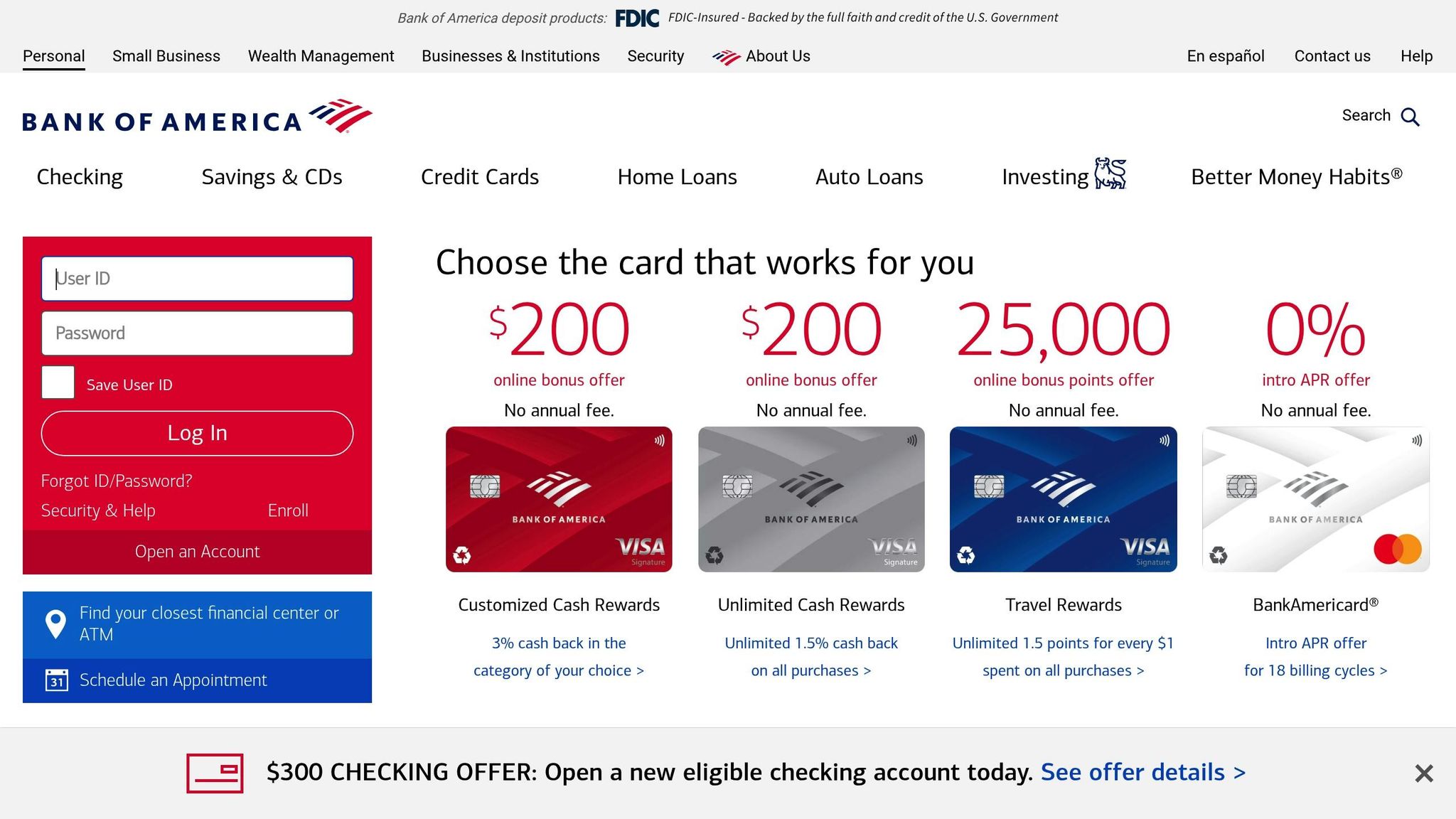

Bank of America‘s Erica

Erica has handled over 1 billion client interactions, showcasing how AI can assist with:

- Keeping an eye on accounts for duplicate charges

- Managing bill payments and recurring expenses

- Helping replace lost or stolen cards

- Syncing with the FICO® Score Tracker for credit insights

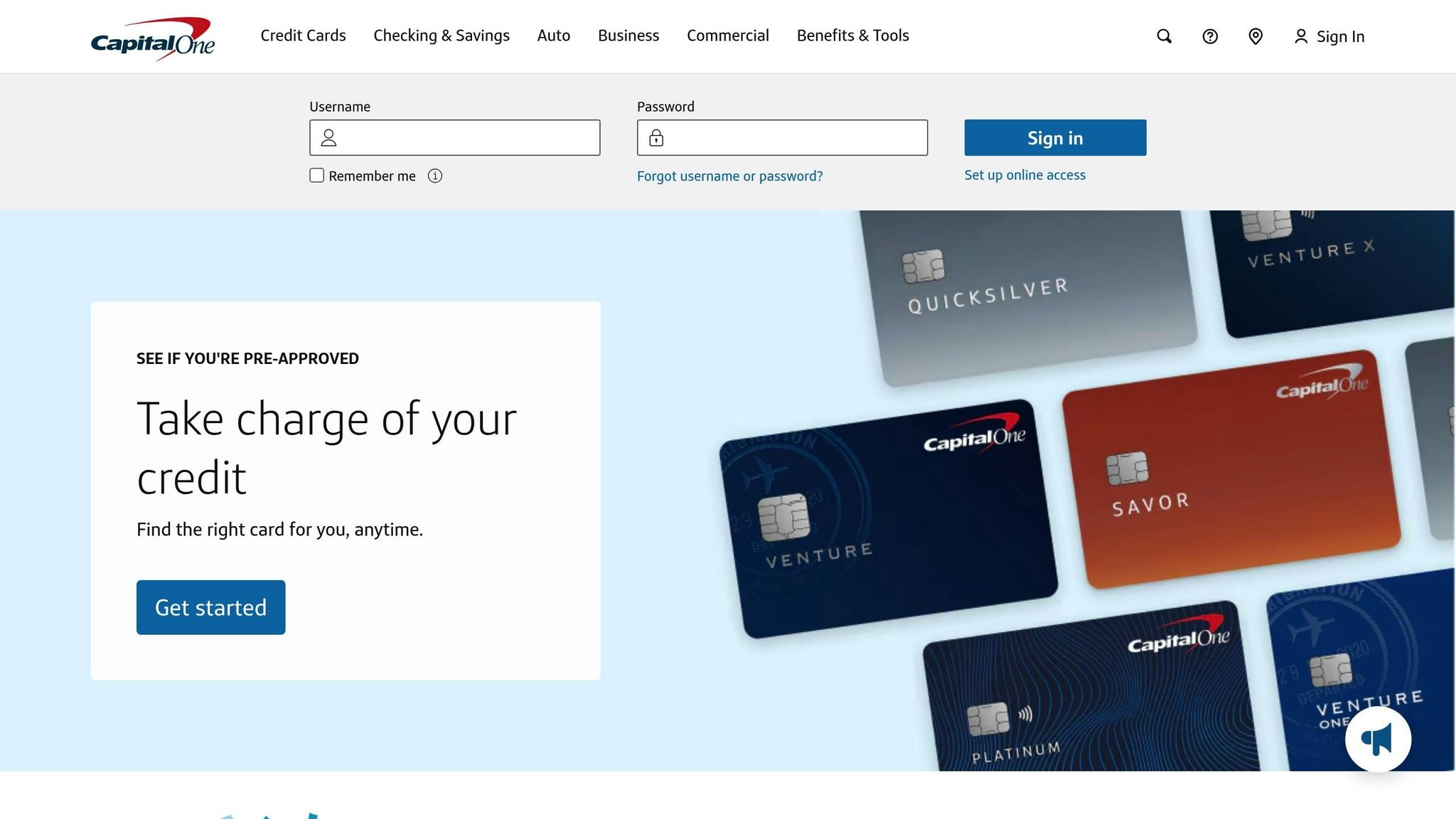

Capital One‘s Eno

Eno is built for security and real-time alerts, offering:

- Alerts for suspicious activity as it happens

- Virtual card numbers for safer online shopping

- Bill payments via text messages

- Analysis of spending patterns

- Notifications for duplicate charges

HSBC‘s Amy

Amy stands out with its multilingual capabilities, assisting customers with:

- Checking account balances

- Reviewing past transactions

- Finding nearby branches and ATMs

- Answering basic product-related questions

JPMorgan Chase‘s COIN

COIN takes a different approach, focusing on internal processes, such as:

- Reviewing legal documents

- Analyzing contracts

- Assessing risks

- Ensuring compliance with regulations

DNB Bank‘s chatbot, Aino, has automated 50–60% of incoming chats and 22% of service requests. According to their Group Executive Vice President:

"Our chatbot AINO is the most efficient employee in DNB".

These examples highlight how chatbots are no longer just answering basic questions – they’re becoming essential tools for customer service and operations. In fact, Gartner predicts that by 2027, nearly 25% of organizations will rely on these AI-driven assistants. AI is clearly reshaping the future of banking.

Security and Compliance Features

In banking, security is just as critical as customer service. AI chatbots are reshaping how banks handle security and compliance, offering around-the-clock monitoring to protect financial data and adhere to regulatory requirements.

Spotting and Stopping Fraud

Banking chatbots keep an eye on transactions in real time, scanning for unusual activity and responding immediately to potential threats. For instance, if a large withdrawal happens in an unfamiliar location, the chatbot notifies the customer and security team. These systems are designed to detect warning signs like:

- Multiple failed login attempts

- Transactions from unexpected locations

- Sudden changes in spending habits

- Large withdrawals that deviate from normal patterns

- Attempts to access accounts without authorization

In addition to fraud detection, these chatbots also help secure customer identities and combat money laundering.

Identity Checks and Money Laundering Prevention

Chatbots simplify Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. By using OCR (optical character recognition), they can verify documents in minutes, guiding customers through the process and flagging inconsistencies on the spot. This includes steps like:

- Instant document analysis

- Automated data capture

- Guided customer verification

- Creating an audit trail

- Immediate alerts for mismatched or suspicious data

Data Protection Methods

Data protection is a major concern for consumers. A survey found that 73% of people worry about their data privacy when using chatbots. To address these concerns, banks implement robust security measures, using multiple layers of protection as shown below:

| Security Layer | Purpose | Implementation |

|---|---|---|

| Encryption | Protect data in transit | HTTPS and end-to-end encryption |

| Access Control | Manage user permissions | Authentication and authorization |

| Compliance | Meet legal requirements | GDPR and CCPA adherence |

| Monitoring | Detect suspicious activity | Automated 24/7 surveillance |

"To ensure your chatbot operates ethically and legally, focus on data minimization, implement strong encryption, and provide clear opt-in mechanisms for data collection and use." – Steve Mills, Chief AI Ethics Officer, Boston Consulting Group

The risks of security failures are severe. For example, in 2019, British Airways was fined £183 million after exposing the personal details of 500,000 customers due to poor security practices. Under GDPR, companies can face penalties of up to €20 million or 4% of their global annual revenue for non-compliance.

sbb-itb-58cc2bf

Customer Service Improvements

AI chatbots are changing the way banks support their customers. They provide quicker, more tailored help while cutting down on costs.

Round-the-Clock Banking Help

AI chatbots are available 24/7, handling multiple questions at once. They can automate up to 75% of customer inquiries across different platforms. Common tasks include:

- Checking account balances

- Reviewing transaction history

- Helping with bill payments

- Solving basic issues

- Locating branches and ATMs

These tools have cut response times by up to 40%. This constant availability also opens the door to more personalized financial advice.

Tailored Financial Guidance

Today’s banking chatbots go beyond answering questions. They analyze spending habits and financial behaviors to offer tailored advice. Here’s how they help:

| Advice Type | How It Works | Benefit to Customers |

|---|---|---|

| Spending Insights | Tracks purchases | Helps cut unnecessary costs |

| Budgeting Assistance | Builds custom budgets | Encourages saving |

| Investment Suggestions | Considers risk profiles | Aids in growing wealth |

| Product Recommendations | Matches needs | Finds the right solutions |

Simplified Account Tasks

AI chatbots also make everyday banking easier. They handle tasks like setting up automatic payments, updating contact details, adjusting card limits, scheduling transfers, and reporting lost cards. These systems can manage up to 80% of customer support questions, freeing up staff to focus on more complex issues.

These features highlight how AI chatbots are reshaping banking by simplifying routine tasks and offering more personalized financial advice.

Creating Banking AI Chatbots

Building AI chatbots for banking requires careful planning to ensure they function effectively while maintaining robust security.

Key Features to Include

Banking chatbots must balance customer service efficiency with strong data protection. Here are some essential features:

| Feature | Purpose | Security Benefit |

|---|---|---|

| Advanced NLP | Understands customer queries in multiple languages | Reduces chances of misinterpretation |

| Multi-Factor Authentication | Confirms user identity | Blocks unauthorized access |

| Encryption Protocols | Secures data during transmission | Protects sensitive information |

| Regulatory Compliance | Adheres to legal standards like GDPR and PCI DSS | Ensures lawful operations |

| Audit Logging | Tracks activity during deployment and use | Enhances security monitoring |

The Consumer Financial Protection Bureau (CFPB) emphasizes the need for these chatbots to "comply with all applicable federal consumer financial laws". This underscores the importance of making security and compliance top priorities.

Preparing Your Banking AI Chatbot

Training a banking chatbot requires a structured approach to ensure both functionality and security:

- Data Integration: Securely connect banking systems, upload relevant documentation, and train the chatbot using FAQs and past customer interactions.

- Security Measures: Implement encryption, set up access controls, apply data minimization techniques, and establish audit trails for tracking activities.

Once the chatbot is trained and security protocols are in place, it’s time to integrate it into your banking services.

Deploying Chatbots Across Banking Channels

After setup, the chatbot should be deployed across multiple platforms to provide broad service coverage.

- Channel Integration: Launch the chatbot on websites, mobile apps, secure messaging platforms, and even in-branch systems.

- Testing and Monitoring: Perform security checks, verify response accuracy, conduct load testing during peak usage, and ensure compliance with regulations.

Ongoing updates and monitoring are critical. Regular audits and maintaining interaction logs help banks uphold security standards and meet compliance requirements.

What’s Next for Banking Chatbots

New AI Tools and Features

Banking chatbots are shifting from simply reacting to customer inquiries to offering predictive and proactive support. Here’s how this evolution is shaping up:

| Feature | Current State | Future Outlook |

|---|---|---|

| Fraud Detection | Used by 38% of banks | Expected to reach 95% adoption for fraud alerts by 2025 |

| Market Size | Limited use today | Projected to grow into a $455 million industry by 2027 |

| Language Support | Basic translations | Advanced natural language processing with better accuracy |

| Security Protocols | Standard encryption | Improved authentication systems to prevent breaches |

Voice banking is also gaining traction, which means banks are working on stronger defenses against voice fraud and impersonation. Tools like Erica hint at the potential of future chatbot capabilities. However, there are still hurdles that could slow down progress.

Progress and Problems

Even with ongoing advancements, banks face several challenges in fully implementing AI-powered chatbots:

Security Issues

- Building secure connections between AI tools and older banking systems.

- Strengthening safeguards for voice recognition features.

- Meeting strict data privacy regulations.

Technical Barriers

- Ensuring compatibility with legacy systems.

- Keeping AI models updated and well-trained.

- Maintaining accuracy across multiple languages.

"Integrating new technology with legacy systems and ensuring accurate multi-language performance remain ongoing challenges."

While today’s chatbots efficiently handle routine tasks, they need to adapt to tackle more complex demands. Overcoming these challenges will be essential to maintaining the improvements in customer service that AI has already delivered.

Some of the key advancements on the horizon include:

- Real-time fraud detection using pattern recognition.

- Personalized financial advice powered by AI.

- Better multilingual support that accounts for cultural nuances.

Conclusion: AI’s Role in Modern Banking

AI chatbots are reshaping banking by improving both operations and security. Automation now manages up to 75% of inquiries across digital platforms, making these tools a key asset for financial institutions.

For example, DNB’s virtual agent handles thousands of queries each month, showcasing how AI enhances efficiency. Thanks to large language models (LLMs), chatbots can now tackle more complex tasks. However, banks must remain cautious – LLMs can produce inaccurate responses (3% to 27% of the time).

Looking ahead, Gartner forecasts that by 2027, nearly 25% of organizations will use chatbots as their main customer service channel. Banks adopting AI-driven tools report benefits like cost savings, better customer acquisition, and quicker responses to market changes.

To succeed, banks need AI chatbots that blend automation with human oversight. Priorities include offering tailored support, maintaining strict security, integrating with existing systems, and supporting multiple languages.

Interested in streamlining your banking support? Build a secure AI chatbot with Quidget.